31+ how to calculate excess return

Since the size and the length of. Present value of excess returns 359233 109 329566.

You Run A Regression Of A Stock A S Excess Return On Chegg Com

Web In finance a return is a profit on an investment measured either in absolute terms or as a percentage of the amount invested.

. Web first I calculated the returns with ln priceprice on previous week then I did this with the 3M T-bill rate. Web About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features NFL Sunday Ticket Press Copyright. Ln rate100 1 52.

Web Average return used in Sharpe Ratio and found in your performance page is your average daily returns. Pre-loaded in your workspace is the object rf. After thinking about it for a while.

Web For exchange-traded funds ETFs the excess return should be equal to the risk-adjusted or beta measure that exceeds the instruments benchmark or annual. Web Excess return also known as alpha is a measure of how much a fund has under or outperformed the benchmark against which it is compared. It wouldnt make sense to first calculate the excess return for the Long an Short leg separately as we would simply remove the rf.

Web Up to 25 cash back It is calculated by taking the mean of excess returns returns - risk-free rate divided by the volatility of the returns. Web But if you have monthly data I would calculate the monthly ratio based on the average and std dev of all the monthly data not the average monthly return for each. The riskless rate on T-Bills was only 3 so to calculate the excess returns enjoyed by investors in Big Blue.

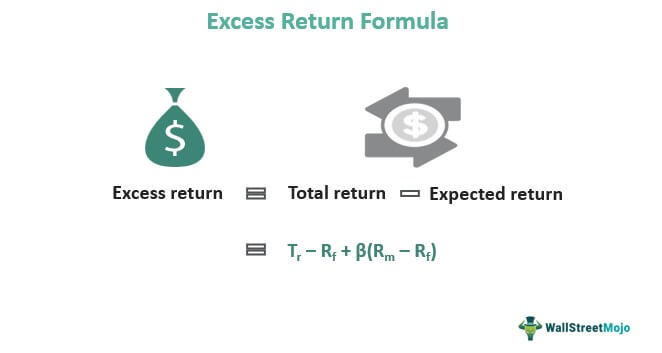

Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. Web We take the excess returns and divide them by our cost of equity we just calculated. Web Mathematically speaking excess return is the rate of return that exceeds what was expected or predicted by models like the capital asset pricing model CAPM.

Web Geometric Sharpe Ratio is the geometric mean of compounded excess returns divided by the standard deviation of those compounded returns. Normally the market return of a given day is calculated from the previous days close not from that days open so the return on day 2 is 57072 56251 821 or. I divided the rate by 100 because it was.

Web Active Return Calculator. Each day we record your portfolio value the change from. Web Mary notices the Big Blue Mutual Fund had a return of 12 last year.

In order to perform a robust analysis on your portfolio returns you must first subtract the risk-free rate of return from your portfolio returns. Web Up to 25 cash back Excess returns. Web In order to calculate excess returns subtract the returns on a risk-free investment from the returns on an investment and that will equal the excess returns.

Online finance calculator to calculate active return excess return to that segment of the returns in an investment portfolio. Web As an investor or a business owner you should understand the definition of excess returns and the excess returns formula what the term means for your stocks. It can be calculated under the.

Struggling To Understand The Value Of Bond Funds In My Situation Bogleheads Org

Excess Returns Financial Data And Calculation Factory

Image4 Jpg

Lbcer8kex992 2020q4

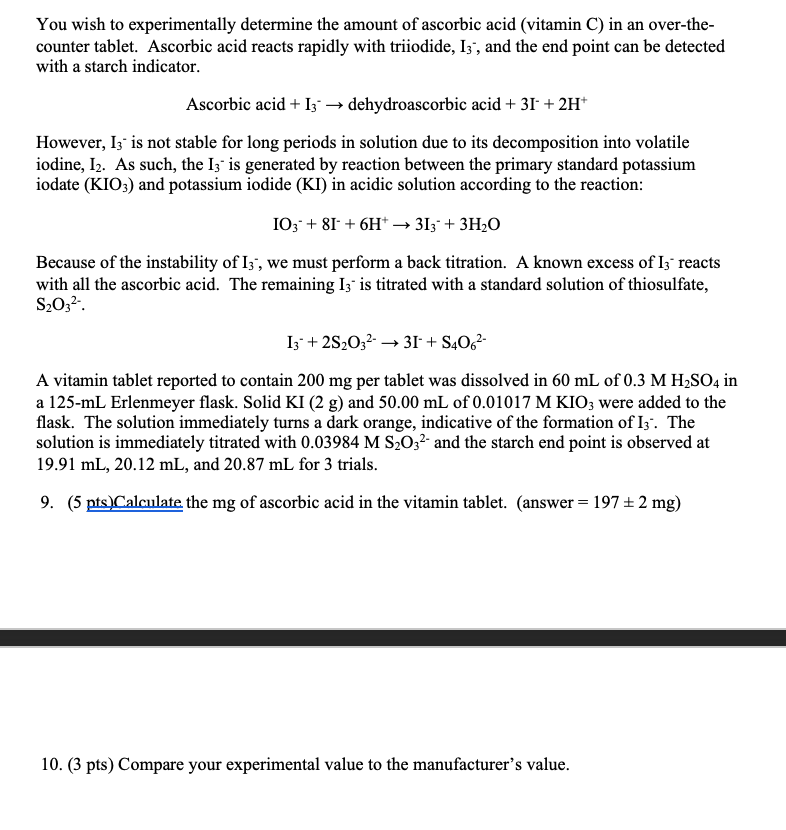

Solved You Wish To Experimentally Determine The Amount Of Chegg Com

Lbcer8kex992 2020q4

Sharpe Ratio Definition Formula Calculation Examples

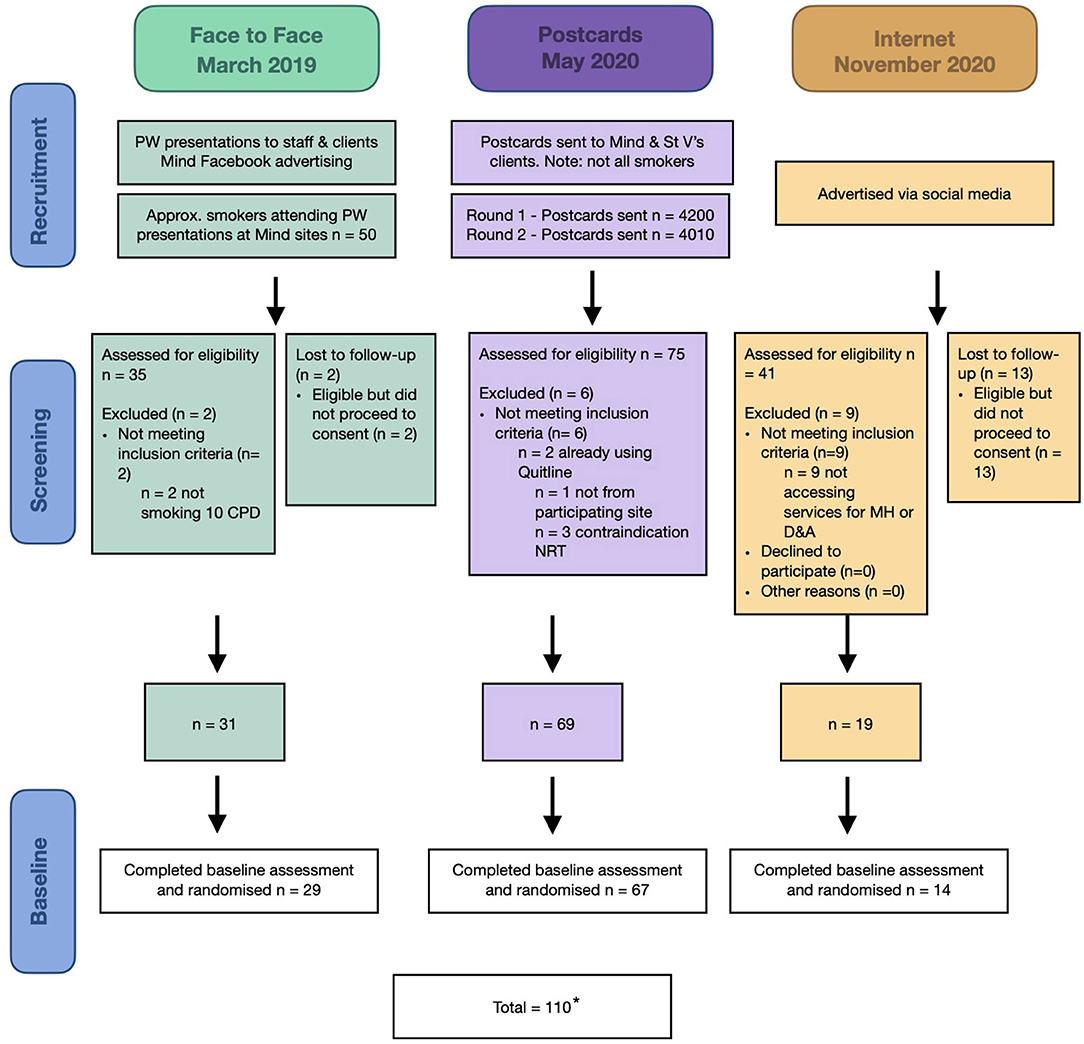

Frontiers Adapting Peer Researcher Facilitated Strategies To Recruit People Receiving Mental Health Services To A Tobacco Treatment Trial

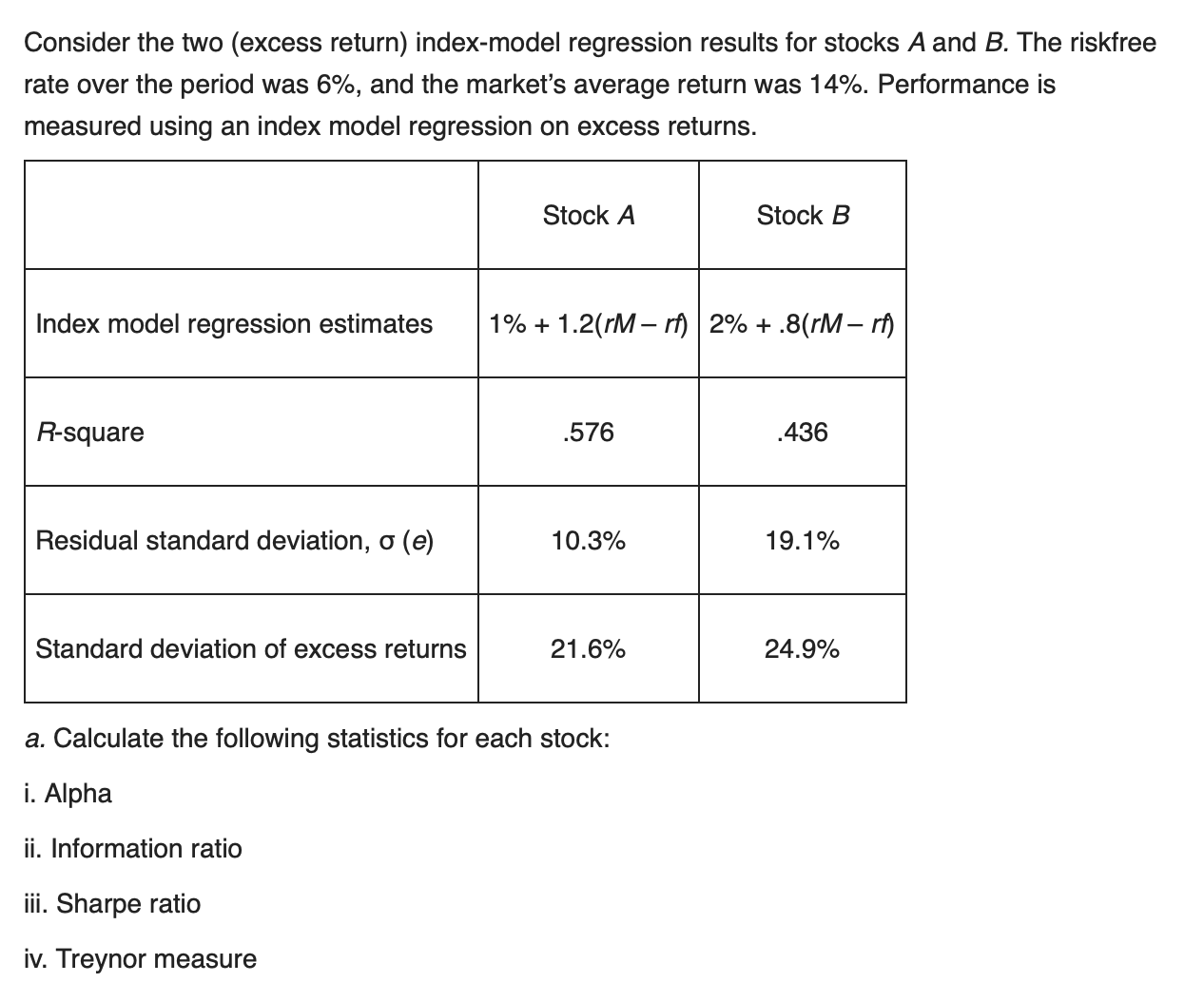

Solved I Need Help With The Calculations For The Sharpe Chegg Com

First Principles Collision Cross Section Measurements Of Large Proteins And Protein Complexes Analytical Chemistry

:max_bytes(150000):strip_icc()/dotdash_Final_Excess_Returns_Dec_2020-01-2a81d7a448684458b0ed30db04fd145c.jpg)

Excess Returns Meaning Risk And Formulas

Excess Return Meaning Explanation Formula Calculations

Calculate The Sharpe Ratio With Excel

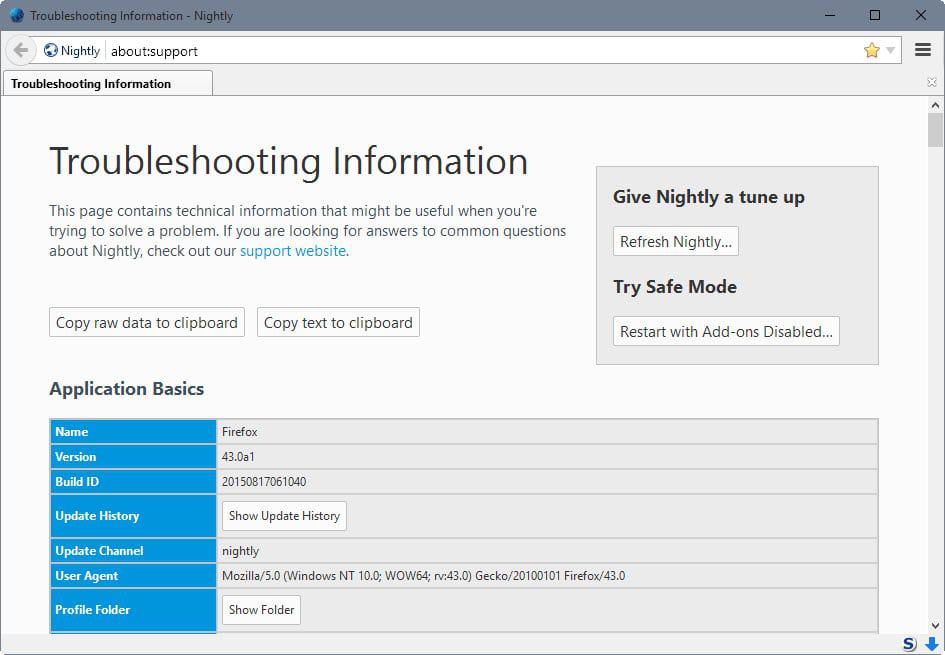

A Comprehensive List Of Firefox Privacy And Security Settings Ghacks Tech News

Calculate The Sharpe Ratio With Excel

Excess Returns Fundsnet

:max_bytes(150000):strip_icc()/GettyImages-160519027-9bc7b5b9500346eda384937f12423c93.jpg)

Excess Returns Meaning Risk And Formulas